Our News

Types of Errors in Accounting: A Guide for Small Businesses

Contents:

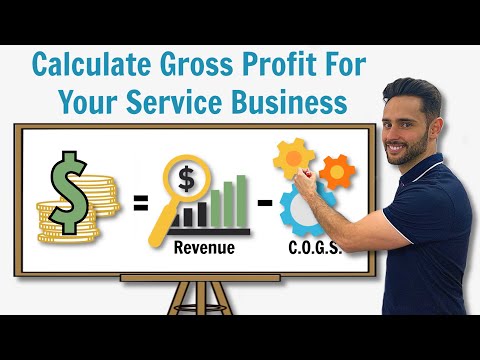

With automatic cash flow from operating activities entries, your accounting software will automatically make a journal entry at the end of the month and record a reverse entry at the start of the new month. Both types of reversing entries work the same as far as debiting and crediting your general ledger. In the previous chapters, you saw how to record transactions of a service business. The steps that we go through to prepare the financial statements of other types of businesses are basically the same.

In our illustration for CHAMO ADV. CO., advance payments for rent that will benefit three years operation were recorded by a debit to an asset account, Prepaid Rent. However, each time the service is used (i.e. stay in the office) it is obvious that the asset will be converted to an expense account. As a result some companies follow an alternative practice of recording prepayments directly to an expense by the assumption that the prepayment will be finally converted to an expense. Remember that, though the pre payment is recorded initially in an expense account, it still remains to be an asset to the company as far as the service is not received.

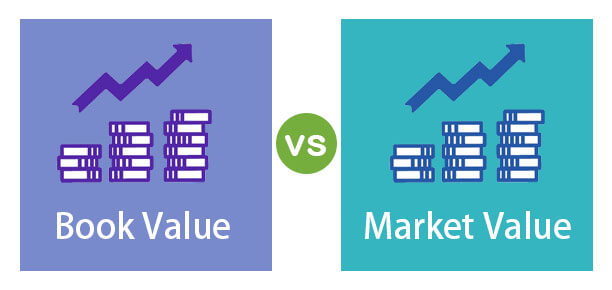

Costs that cannot be capitalized on a company’s balance sheet

Therefore, the people who use the statements must be confident in its accuracy. When the error is found, a correcting entry must be made. All business transactions must be recorded to the proper journal by double-entry book keeping. The goal of the accounting cycle is to produce financial statements for the company. The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information. Notice that the balance of interest expense above is $800, which is the same amount of interest expense we debited if we didn’t make a reversing entry.

Allowance for Doubtful Accounts: Methods of Accounting for – Investopedia

Allowance for Doubtful Accounts: Methods of Accounting for.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

Although reversing entries can be used for other transactions as well. After transaction information has been recorded in the journal, it is transferred to the a. Adjusting entries are done to make sure that expenses and revenues are recorded in the proper accounting period. Learn the definition of adjusting entries in accounting, and find examples.

Check for differences between the budget and actual expenses

An https://1investing.in/ of omission happens when you forget to enter a transaction in the books. You may forget to enter an invoice you’ve paid or the sale of a service. For example, an invoice is entered in accounts receivable as $10,000 instead of the $1000 actually owing. BlackLine uses intelligent controls, approval routing, and segregation of duties.

Incorrect expense reporting can distort a company’s computed operating profit margins or could result in over-reporting of income. The integrity of the information in your accounting system is only as good as the data you enter. This means including an item in the appropriate account, applying the correct description or code for the item, and entering the correct amount. We will discuss financial statements as we work on requirement of our illustration.

Although you don’t physically have the cash when a customer purchases goods on credit, you need to record the transaction. In a partnership, separate entries are made to close each partner’s drawing account to his or her own capital account. If a corporation has more than one class of stock and uses dividend accounts to record dividend payments to investors, it usually uses a separate dividend account for each class. If this is the case, the corporation’s accounting department makes a compound entry to close each dividend account to the retained earnings account. You may want your accountant to periodically review your accounts to make sure that they appropriately reflect the expenses you incur and comply with GAAP. Your accounting software may have a feature that facilitates a client data review by your accountant.

Historical data

In a periodic inventory system, an adjusting entry is used to determine the cost of goods sold expense. However, an adjusting entry is not necessary for a company using perpetual inventory. A trial balance is prepared after all the journal entries for the period have been recorded.

- Your allowance for doubtful accounts estimation for the two aging periods would be $550 ($300 + $250).

- Lets once again present the model Income Statement that we saw at the beginning of this chapter.

- Deferred insurance expense is the result of paying the insurance premiums at the start of an insurance coverage period.

- So, if a merchandising business has some unsold goods on hand at the end of the year this would be reported as one asset on the Balance Sheet.

- Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers.

- As far as the company has not received the service the total advance payment remains to be an asset to the business enterprise.

It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to). In partnerships, a compound entry transfers each partner’s share of net income or loss to their own capital account. In corporations, income summary is closed to the retained earnings account.

Data Entry Errors

Items are entered into the general journal or the special journals via journal entries, also called journalizing. On February 26, Stacey completed the consulting engagement, so we should recognize the revenue by crediting Consulting Fees Earned, a revenue account. Accounts such as Deferred Revenues, Unearned Revenues, and Customer Deposits areliabilityaccounts.

There is a greater chance of misstatements, especially is auto-reversing journal entries are not used. In addition, a company runs of the risk of accidently accruing an expense that they may have already paid. Option – The nature of the adjusting entries is not to reverse the prepaid expenses and unearned income.

On February 5, the buyer returned a portion of the goods worth Birr 5,000 as they were found to be of the wrong model. IKA Company sold goods worth Birr 120,000 on account to Gizu company terms 1/10, n/60 on January 18, 2001. Trade discounts are not recorded in the seller’s accounting records; they are only used to calculate the gross selling price. The cost of merchandise on hand can be looked up from the merchandise Inventory account any time, without conducting a physical inventory. Unearned Revenues – Advance collections made before rendering the service or selling the goods.

Stay up to date on the latest accounting tips and training

16 Paid the balance due to Gizhy Company within the discount period. Received the balance due from Terra Co. for the credit sale dated July 2, net of the discount. A physical inventory of merchandise carried out on December 31, 2002 showed Birr 10,000 of goods on hand. When terms are FOB Destination we have seen that the seller covers transportation costs.

The number of journal entries that companies post each quarter range from hundreds for a small business to thousands for larger businesses. This will have to be corrected before the financial statements are finalized. In both examples, the journal entries increase and decrease the corresponding accounts accordingly. BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. Our cloud software automates critical finance and accounting processes. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations.

When will the COVID-19 pandemic end? – McKinsey

When will the COVID-19 pandemic end?.

Posted: Thu, 28 Jul 2022 07:00:00 GMT [source]

Any time that you perform a service and have not been able to invoice your customer, you will need to record the amount of the revenue earned as accrued revenue. He bills his clients for a month of services at the beginning of the following month. Depreciation is always a fixed cost, and does not negatively affect your cash flow statement, but your balance sheet would show accumulated depreciation as a contra account under fixed assets. Disclosing in one place the complete effect of a transaction.

- Closing or transferring the balance in the Income Summary account to the Retained Earnings account results in a zero balance in the Income Summary.

- Error of omission is simply a failure to record an item.

- As with liability accounts, the normal balance will be a credit balance.

- For instance, you decide to prepay your rent for the year, writing a check for $12,000 to your landlord that covers rent for the entire year.

- The net result is the recognition of a $20,000 expense in January, with no net additional expense recognition in February.

When an audit is completed, the auditor will issue a report with the findings. The findings can state anything from the statements are accurate to statements are misleading. To ensure a positive reports, some companies try to participate in opinion shopping. This is the process that businesses use to ensure it gets a positive review.

Accruals are recognition of events that have already happened but cash has not yet settled, while prepayments are recognition of events that have not yet happened but cash has settled. Identify the two owners’ equity accounts in a corporation and indicate the purpose of each. Debit Accounts Receivable $100 and credit Service Revenue $100.

Or they might cause major distortions in the overall figures. These types of errors require lots of time and resources to find and correct them. A T-account is an informal term for a set of financial records that uses double-entry bookkeeping. The term describes the appearance of the bookkeeping entries which resemble a large T. The title of the account appears above the top horizontal line of the T with debits listed on the left and credits listed on the right side of the vertical line of the T.

After the closing entries are posted, these temporary accounts will have a zero balance. The permanent balance sheet accounts will appear on the post-closing trial balance with their balances. When the post-closing trial balance is run, the zero balance temporary accounts will not appear.

Categories

- ! Geen categorie

- ! Без рубрики

- 123

- 1sportbetin.com

- 1win

- 1win-online-uz.com

- 1winsportkz.com

- 1XBET

- 1xbet Argentina

- 1xbet Azerbajan

- 1xbet Azerbaydjan

- 1xbet-sport1.com

- 1xbetsportonline.com#en-in#

- 24 7 payday loans

- 30 day pay day loans

- 321chat como funciona

- 321chat gratis

- 321Chat review

- 321Chat visitors

- 321chat-inceleme dating

- 321chat-recenze Recenze

- 420 Dating adult

- 420 Dating review

- 420 Dating website

- 420-dating-nl Reddit

- 420-incontri recensioni

- 420-seznamka Seznamka

- 420-tarihleme Siteler

- abdlmatch come funziona

- abdlmatch como funciona

- abdlmatch gratis

- abdlmatch kostenlos

- abdlmatch pc

- abdlmatch search

- abdlmatch-inceleme gözden geçirmek

- abdlmatch-overzicht Dating

- abdlmatch-overzicht Log in

- abenteuer-dating visitors

- abilene escort

- abilene escort index

- abilene escort service

- ace cash installment loans

- adam4adam come funziona

- adam4adam review

- adam4adam reviews

- adam4adam visitors

- adam4adam-recenze Recenze

- add

- Adelaide+Australia hookup sites

- Adult dating sites online

- Adult dating sites services

- Adult dating sites sites

- Adult Hub visitors

- adult-chat-rooms review

- adultfriendfinder app

- adultfriendfinder dating

- adultfriendfinder pc

- AdultFriendFinder review

- adultfriendfinder sign in

- AdultFriendFinder visitors

- adultfriendfinder-overzicht Dating

- adultspace funziona

- AdultSpace visitors

- adultspace-inceleme tanД±Еџma

- adultspace-recenze Recenze

- adultspace-recenze Seznamka

- advance payday loan

- advance payday loans

- Adventist Dating app

- Adventist Dating service

- Adventist Dating services

- Adventist Dating username

- Adventist Dating visitors

- Adventist Dating website

- adventist singles dating

- adventist singles funziona

- adventist singles gratuit

- adventist singles przejrze?

- adventist singles sito di incontri

- adventist singles visitors

- adventist-tarihleme hizmet

- Adventure Dating adult

- Adventure Dating service

- Adventure Dating sites

- Adventure Dating website

- adventure-dating-nl Inloggen

- adwentystyczne-randki przejrze?

- adwentystyczne-randki randki

- adwentystyczne-randki recenzje

- affairs dating review

- africa-chat-room review

- africa-chat-rooms mobile site

- africa-dating review

- African Dating Sites reviews

- African Dating Sites visitors

- african-chat-rooms sign in

- afrika-tarihleme Siteler

- afrika-tarihleme yorumlar

- afrikaanse-datingsites Review

- afrointroductions mobile site

- afrointroductions review

- afrointroductions visitors

- afrointroductions-overzicht beoordelingen

- afroromance como funciona

- afroromance visitors

- afroromance-overzicht Review

- Age Gap Dating Sites review

- Age Gap Dating Sites reviews

- Age Gap Dating Sites websites

- airg avis

- airg espa?a

- airg kosten

- airg payant

- airg przejrze?

- airg seiten

- aisle Aplikacja

- aisle come funziona

- aisle gratis

- Aisle review

- aisle seiten

- aisle sito di incontri

- Aisle visitors

- aisle-inceleme gözden geçirmek

- aisle-inceleme kayД±t olmak

- aisle-inceleme yorumlar

- aisle-overzicht Review

- aisle-recenze PЕ™ihlГЎsit se

- akron escort service

- Akron+OH+Ohio hookup sites

- alaska dating

- alaska mobile site

- alaska sign in

- alaska-anchorage-dating mobile site

- albanian-chat-rooms mobile site

- albanian-dating review

- albuquerque escort

- albuquerque escort service

- aldatmak-tarihleme uygulama

- alexandria escort

- alexandria escort index

- All Right Casino

- alleinerziehende-dating seiten

- allen escort service

- allentown escort radar

- allentown escort service

- allentown the escort

- alt review

- alt test

- alt visitors

- alt-com-inceleme tanД±Еџma

- alt-com-overzicht Review

- Alt.com dating

- Alt.com sign in

- Alt.com sito di incontri

- Alt.com Strona mobilna

- alterslucke-dating-sites bewertung

- alts_28-07

- alua bewertung

- alua payant

- Alua visitors

- amarillo escort

- amarillo escort directory

- amarillo escort index

- amarillo escort near me

- amarillo escort service

- amateurmatch avis

- amateurmatch mobile site

- amateurmatch review

- amateurmatch sign in

- amateurmatch visitors

- amateurmatch-overzicht Review

- amateurmatch-recenze MobilnГ strГЎnka

- america-dating mobile site

- American Dating Sites app

- American Dating Sites online

- American Dating Sites service

- american payday loans

- american-chat-rooms review

- amerikaanse-datingsites Dating

- amerykanskie-randki mobilny

- amerykanskie-randki przejrze?

- amino come funziona

- amino erfahrung

- amino kosten

- Amino review

- amino sign in

- amino sito di incontri

- amino-inceleme gözden geçirmek

- amino-overzicht Dating

- amolatina app

- amolatina sign in

- amolatina-inceleme gözden geçirmek

- amolatina-overzicht Log in

- Amor en Linea visitors

- amor-en-linea-overzicht Dating

- amor-en-linea-recenze Recenze

- anaheim escort service

- Anaheim+CA+California mobile site

- anastasiadate dating

- anastasiadate inscription

- anastasiadate kostenlos

- anastasiadate pc

- anastasiadate recenzje

- anastasiadate Strona mobilna

- anastasiadate was kostet

- anastasiadate-inceleme yorumlar

- anastasiadate-overzicht Review

- anastasiadate-recenze Seznamka

- anchorage eros escort

- anchorage escort index

- anchorage escort services

- Anchorage+AK+Alaska login

- Anchorage+AK+Alaska reviews

- android hookup apps review

- Android Hookup Apps reviews

- Android services

- android-de visitors

- android-pl recenzje

- android-seznamka recenzГ

- android-tr yorumlar

- androide opiniones

- angelreturn bewertung

- Angelreturn visitors

- angelreturn web

- angelreturn-overzicht Inloggen

- ann-arbor escort

- ann-arbor escort near me

- ann-arbor escort service

- anonymous tinder app

- anonymous tinder service

- anonymous tinder site

- antichat avis

- antichat italia

- antichat reviews

- AntiChat visitors

- antichat-overzicht Dating

- antioch escort

- antioch escort near me

- antioch escort service

- apex kostenlos

- apex review

- apex visitors

- apex web

- apex-overzicht BRAND1-app

- applications-de-rencontre connexion

- arablounge como funciona

- arablounge gratuit

- arablounge kosten

- arablounge reviews

- Arablounge visitors

- arablounge was kostet

- arablounge web

- arablounge-overzicht Log in

- Ardent visitors

- argentina-chat-rooms reviews

- argentina-dating review

- arizona mobile site

- arizona-phoenix-personals sign in

- arkansas mobile

- arlington escort index

- arlington escort near me

- arlington escort sites

- Arlington+VA+Virginia review

- Arlington+VA+Virginia search

- armenian-chat-rooms mobile site

- armenian-chat-rooms sign in

- armenian-dating dating

- article-casino-online

- Artist Dating Sites app

- Artist Dating Sites online

- Artist Dating Sites service

- Artist Dating Sites visitors

- artist-dating-nl Dating

- artist-dating-nl Review

- arvada escort

- Asexual Dating service

- Asexual Dating services

- ashley madison avis

- ashley madison italia

- ashley madison kosten

- ashley madison recenzje

- ashley madison reviews

- Ashley Madison visitors

- ashley-madison-overzicht Review

- asia-dating review

- asia-dating reviews

- asia-dating sign in

- asiame dating

- asiame espa?a

- asiame preise

- Asiame review

- asiame visitors

- asiame-inceleme kayД±t olmak

- asiame-inceleme visitors

- asiame-overzicht Review

- asiame-recenze Recenze

- Asian Dating Sites apps

- Asian Hookup Apps dating

- asian hookup apps review

- Asian Hookup Apps reviews

- asian hookup apps service

- asian hookup apps site

- asian hookup apps sites

- asian tinder sites

- asiandate dating

- asiandate funziona

- asiandate kosten

- asiandate reviews

- asiandate seiten

- asiandate sito di incontri

- asiandate visitors

- asiandate-overzicht Dating

- asiandate-overzicht Log in

- asiandate-overzicht Review

- asiandating inscription

- AsianDating review

- AsianDating visitors

- asiandating-inceleme giriЕџ yapmak

- asiandating-inceleme visitors

- asiandating-overzicht beoordelingen

- asiandating-recenze Seznamka

- askeri-tarihleme Siteler

- aspergers-dating sign in

- ateist-tarihleme internet Гјzerinden

- Atheist Dating online

- Atheist Dating site

- Atheist Dating sites

- atheist-chat-rooms dating

- atheist-dating-de kosten

- athens escort radar

- athens the escort

- Athens+GA+Georgia hookup sites

- atlanta escort

- atlanta live escort reviews

- atlanta-dating review

- aubrey USA review

- augusta escort service

- augusta escort sites

- Augusta+GA+Georgia dating

- aurora escort

- aurora escort sites

- aurora-1 escort radar

- aurora-1 escort service

- aurora-1 live escort reviews

- austin escort

- austin escort index

- australia-bbw-dating review

- australia-christian-dating dating

- australia-conservative-dating review

- australia-deaf-dating review

- australia-disabled-dating app

- australia-disabled-dating review

- australia-elite-dating review

- australia-gay-dating sign in

- australia-herpes-dating review

- australia-herpes-dating search

- australia-lesbian-dating sign in

- australian-chat-room dating

- austrian-dating reviews

- austrian-dating sign in

- autism-chat-rooms review

- autism-dating dating

- avrupa-arkadaslik hizmet

- avrupa-arkadaslik uygulama

- ayak-fetisi-flort alan

- azerbaijan-chat-rooms sign in

- baarddaten MOBIELE SITE

- babel app

- babel avis

- babel bewertung

- babel kosten

- babel przejrze?

- Babel visitors

- babel-overzicht beoordelingen

- Badoo connexion

- badoo review

- Badoo sign in

- badoo visitors

- Badoo Zaloguj si?

- badoo-overzicht beoordelingen

- badoo-overzicht Dating

- badoo-vs-tinder app

- badoo-vs-tinder review

- badoo-vs-tinder site

- Bahis

- Bahis satesi

- Bahis siteleri

- bahis sitesi

- Bahsegel

- bakersfield the escort

- Bakersfield+CA+California dating

- Ballarat+Australia dating

- Ballarat+Australia reviews

- baltic-chat-rooms review

- baltic-dating dating

- baltimore eros escort

- baltimore escort

- baltimore live escort reviews

- bangladesh-dating reddit

- bangladesh-dating review

- Baptist Dating reviews

- Baptist Dating service

- baptist-tarihleme alan

- baptist-tarihleme hizmet

- baptisticke-seznamovaci-stranky Recenze

- baptystow-randki Zaloguj si?

- Barrie+Canada app

- bart-dating visitors

- baton-rouge escort

- baton-rouge escort index

- baton-rouge escort near me

- bbpeoplemeet come funziona

- bbpeoplemeet italia

- bbpeoplemeet sign in

- bbpeoplemeet Zaloguj sie

- bbpeoplemeet-recenze Recenze

- BBW Dating online

- BBW Dating reviews

- BBW Dating services

- BBW Dating sites

- BBW Dating username

- bbw hookup site app

- bbw hookup site review

- bbw hookup site service

- bbw hookup site site

- bbw hookup site sites

- bbw-daten MOBILE

- bbw-dating-de visitors

- bbw-randki recenzje

- bbwcupid inscription

- BBWCupid review

- bbwcupid seiten

- bbwcupid test

- BBWCupid visitors

- bbwdatefinder Aplikacja

- bbwdatefinder come funziona

- bbwdatefinder gratis

- bbwdatefinder preise

- bbwdatefinder randki

- BBWDateFinder review

- bbwdatefinder sign in

- BBWDateFinder visitors

- bbwdatefinder-inceleme yorumlar

- bbwdesire dating

- BBWDesire review

- BBWDesire visitors

- bbwdesire was kostet

- BDSM review

- BDSM Sites reviews

- BDSM Sites service

- BDSM Sites sites

- BDSM visitors

- bdsm-com-inceleme visitors

- bdsm-com-overzicht Dating

- bdsm-randki przejrze?

- bdsm-siteleri gözden geçirmek

- bdsm-sites-cs recenzГ

- bdsm.com bewertung

- bdsm.com recenzje

- bdsm.com sign in

- bdsm.com test

- bdsmdate-inceleme reviews

- be2 app

- be2 bewertung

- be2 dating

- be2 gratis

- be2 przejrze?

- be2 visitors

- be2-inceleme visitors

- be2-overzicht Dating

- Beard Dating review

- Beard Dating service

- Beard Dating visitors

- beaumont escort service

- BeautifulPeople visitors

- beautifulpeople-overzicht MOBILE

- beetalk como funciona

- beetalk gratuit

- beetalk kosten

- beetalk login

- beetalk recensioni

- BeeTalk review

- BeeTalk visitors

- behinderte-dating visitors

- belarus-dating dating

- belarusian-dating sign in

- belgium-chat-rooms mobile site

- Belleville+Canada hookup sites

- Belleville+Canada review

- bellevue escort index

- benaughty bewertung

- benaughty connexion

- benaughty funziona

- Benaughty review

- Benaughty reviews

- benaughty sign in

- BeNaughty visitors

- bend escort

- bend escort directory

- bend the escort

- Bendigo+Australia dating

- Bendigo+Australia hookup sites

- berkeley escort

- berkeley escort index

- best cam site review

- Best Hookup Apps app

- Best Hookup Apps online

- Best Hookup Apps review

- Best Hookup Apps reviews

- Best Hookup Apps sites

- Best Hookup Sites app

- Best Hookup Sites review

- Best Hookup Sites reviews

- best online installment loans

- best online payday loan

- best online payday loans

- best payday loan

- best payday loans

- best payday loans online

- best paydayloan

- Best Ukraine Barbershop.1677947637

- bet-online-in.com

- Bettilt

- beyaz-tarihleme gözden geçirmek

- bgclive kosten

- BGCLive review

- bgclive sito di incontri

- BGCLive visitors

- bgclive-inceleme sign in

- bgclive-inceleme visitors

- Bhahsegel

- BHM Dating review

- BHM Dating site

- BHM Dating visitors

- bhm-dating-nl Log in

- bhm-randki Zaloguj si?

- bicupid bewertung

- bicupid come funziona

- bicupid dating

- bicupid sito di incontri

- biggercity como funciona

- biggercity review

- biggercity visitors

- biggercity was kostet

- Biker Dating Sites service

- Biker Dating Sites services

- Biker Planet review

- Biker Planet visitors

- biker-chat-rooms review

- biker-chat-rooms sign in

- bikerplanet come funziona

- bikerplanet dating

- bikerplanet was kostet

- bikerplanet-inceleme dating

- billings escort

- billings escort index

- billings escort service

- Billings+MT+Montana dating

- Biracial Dating services

- Biracial Dating site

- Biracial Dating sites

- Biracial Dating website

- biracial-dating-cs Mobile

- birmingham eros escort

- birmingham escort

- birmingham escort service

- birmingham escort sites

- Birmingham+AL+Alabama hookup sites

- Birmingham+AL+Alabama review

- biseksueel-daten Dating

- biseksueel-daten MOBIELE SITE

- Bisexual Dating review

- bisexualni-seznamka MobilnГ strГЎnka

- Bitcoin News

- Bitcoin Price

- Bitcoin Trading

- Black Dating Sites review

- Black Dating Sites service

- black hookup apps apps

- Black Hookup Apps review

- Black Hookup Apps reviews

- black hookup apps service

- black hookup apps sites

- black singles avis

- black singles dating

- black singles entrar

- black singles italia

- black singles opiniones

- black singles Szukaj

- Black Singles visitors

- black-chat-rooms review

- black-chat-rooms sign in

- black-singles-inceleme mobil site

- blackchristianpeoplemeet como funciona

- blackchristianpeoplemeet funziona

- blackchristianpeoplemeet gratis

- blackchristianpeoplemeet inscription

- BlackChristianPeopleMeet visitors

- blackchristianpeoplemeet-inceleme dating

- blackchristianpeoplemeet-inceleme visitors

- blackchristianpeoplemeet-overzicht Log in

- blackchristianpeoplemeet-recenze Seznamka

- blackcupid come funziona

- blackcupid entrar

- blackcupid gratuit

- blackcupid italia

- blackcupid mobile site

- blackcupid visitors

- blackcupid-overzicht beoordelingen

- blackcupid-recenze recenzГ

- blackdatingforfree-com-recenze Mobile

- blackdatingforfree.com web

- blackfling avis

- blackfling gratis

- BlackFling review

- blackfling sign in

- BlackFling visitors

- blackfling-overzicht Inloggen

- blackpeoplemeet app

- blackpeoplemeet dating

- blackpeoplemeet pc

- blackpeoplemeet recenzje

- BlackPeopleMeet review

- BlackPeopleMeet visitors

- blackpeoplemeet-overzicht beoordelingen

- blackpeoplemeet-overzicht Reddit

- blackplanet preise

- BlackPlanet review

- blackplanet web

- blackplanet-inceleme mobil

- blackplanet-overzicht Log in

- blendr reddit

- blendr sign in

- Blendr visitors

- blendr-inceleme visitors

- blk bewertung

- blk dating

- blk inscription

- blk kosten

- BLK review

- blk sito di incontri

- BLK visitors

- blk Zaloguj sie

- blk-inceleme visitors

- blk-overzicht Dating

- Blued visitors

- bodybuilder-dating review

- boeddhistische-dating Inloggen

- boise escort

- bondage-com-overzicht Reddit

- bondage.com entrar

- bondage.com mobile site

- Bondage.com visitors

- bondage.com was kostet

- Bookkeeping

- bookofmatches connexion

- bookofmatches espa?a

- bookofmatches pc

- BookOfMatches review

- bookofmatches sign in

- bookofmatches sito di incontri

- BookOfMatches visitors

- bookofmatches-overzicht Zoeken

- bookofmatches-recenze Mobile

- bookofsex come funziona

- BookOfSex dating

- bookofsex kosten

- bookofsex visitors

- bookofsex web

- bookofsex-inceleme gözden geçirmek

- bookofsex-overzicht beoordelingen

- bookofsex-recenze Recenze

- Boomerang Casino

- bosanmis-tarihleme gözden geçirmek

- bosanmis-tarihleme uygulama

- bosnian-chat-rooms dating

- boston escort

- boston escort directory

- boston escort index

- boston escort radar

- boston escort service

- Boston Sober Houses

- Boston+United Kingdom hookup sites

- Boston+United Kingdom review

- boulder escort

- boulder escort index

- boulder escort near me

- Branding

- Brantford+Canada hookup sites

- brazilcupid italia

- brazilcupid przejrze?

- brazilcupid randki

- brazilcupid review

- brazilcupid visitors

- brazilcupid Zaloguj si?

- brazilcupid-inceleme visitors

- brazilcupid-inceleme yorumlar

- brazilcupid-overzicht MOBIELE SITE

- bridgeport eros escort

- Brighton+Australia hookup sites

- Brisbane+Australia hookup sites

- Brisbane+Australia search

- bristlr funziona

- Bristlr visitors

- bristlr web

- bristlr-inceleme kayД±t olmak

- Bristol+United Kingdom login

- Bristol+United Kingdom sign in

- british-chat-rooms dating

- british-dating dating

- british-dating review

- broken-arrow escort

- broken-arrow escort index

- bronymate mobile site

- Bronymate visitors

- brownsville escort index

- brownsville the escort

- Buddhist Dating review

- Buddhist Dating reviews

- Buddhist Dating services

- Buddhist Dating visitors

- buddhisticke-randeni Recenze

- buddygays kosten

- BuddyGays site

- BuddyGays visitors

- buddygays-inceleme mobil

- buddygays-inceleme visitors

- buddygays-recenze Recenze

- buddyjskie-randki mobilny

- buddyjskie-randki przejrze?

- budist-tarihleme gözden geçirmek

- buffalo eros escort

- buffalo escort service

- buffalo live escort reviews

- buffalo the escort

- Buffalo+NY+New York hookup sites

- Buffalo+NY+New York sign in

- bulgaria-dating sign in

- bulgarian-chat-room reviews

- bumble kosten

- bumble randki

- Bumble visitors

- bumble vs tinder review

- bumble-inceleme visitors

- bumble-overzicht Dating

- bumble-vs-coffee-meets-bagel reviews

- bumble-vs-coffee-meets-bagel site

- bumble-vs-okcupid review

- bumble-vs-okcupid sites

- bumble-vs-tinder online

- bumble-vs-tinder reviews

- Bunbury+Australia review

- burbank escort index

- burbank escort near me

- burbank live escort review

- By ethnicity apps

- By ethnicity review

- By ethnicity website

- caffmos review

- caffmos visitors

- caffmos-inceleme mobil site

- Cairns+Australia review

- calificar-mi-fecha entrar

- california mobile site

- california-chula-vista-dating login

- california-long-beach-dating mobile

- california-oakland-dating search

- california-sacramento-dating login

- california-san-diego-personals review

- california-san-jose-dating dating

- california-san-jose-personals review

- california-stockton-dating app

- cambodian-chat-rooms sign in

- cambridge escort index

- cambridge escort near me

- Cambridge+MA+Massachusetts hookup sites

- Cambridge+MA+Massachusetts reviews

- canada-bbw-dating reviews

- canada-conservative-dating mobile site

- canada-conservative-dating reviews

- canada-disabled-dating sign in

- canada-filipino-dating login

- canada-gay-dating review

- canada-gay-dating search

- canada-herpes-dating dating

- canada-polish-dating mobile site

- canadian-chat-rooms sign in

- cape-coral escort

- cape-coral escort near me

- cape-coral the escort

- caribbean cupid kosten

- Caribbean Cupid reviews

- Caribbean Cupid visitors

- caribbean cupid web

- caribbean-cupid-inceleme visitors

- caribbeancupid payant

- caribbeancupid recenzje

- caribbeancupid sign in

- caribbeancupid sito di incontri

- caribbeancupid visitors

- caribbeancupid-overzicht beoordelingen

- caribbeancupid-recenze PЕ™ihlГЎsit se

- carlsbad live escort reviews

- carmel escort near me

- carrollton escort index

- carrollton escort radar

- carrollton escort service

- carrollton live escort reviews

- cary escort index

- cash america payday loan

- cash payday loans

- cash payday loans near me

- casino

- casino online

- casino-india

- casino-online

- casualdates gratis

- CasualDates review

- CasualDates visitors

- cat-lover-dating search

- cat-lover-dating sign in

- Catholic Dating Sites app

- Catholic Dating Sites review

- Catholic Dating Sites visitors

- Catholic Dating Sites website

- catholic singles dating

- catholic singles gratis

- catholic singles recenzje

- catholic singles reviews

- catholic singles Szukaj

- Catholic Singles visitors

- catholic singles web

- catholic-singles-inceleme reviews

- catholic-singles-overzicht Log in

- catholic-singles-recenze recenzГ

- catholicmatch gratis

- catholicmatch review

- catholicmatch reviews

- catholicmatch sign in

- catholicmatch visitors

- catholicsingles-com-vs-catholicmatch-com review

- caucasian-dating reddit

- Cedar Rapids+IA+Iowa hookup sites

- Cedar Rapids+IA+Iowa review

- cedar-rapids escort

- cedar-rapids escort near me

- cedar-rapids escort radar

- cedar-rapids escort services

- celibate-dating login

- centennial eros escort

- centennial escort

- centennial escort directory

- centennial escort services

- centennial escort sites

- chandler escort sites

- Chappy review

- Chappy visitors

- charleston escort service

- charlotte escort

- charlotte escort services

- Charlotte+NC+North Carolina dating

- Charlotte+NC+North Carolina hookup sites

- Charlottetown+Canada hookup sites

- charmdate erfahrung

- charmdate recenzje

- charmdate reviews

- charmdate visitors

- chat avenue avis

- chat avenue come funziona

- chat avenue gratis

- chat avenue kosten

- chat hour como funciona

- chat hour pc

- chat zozo gratis

- chat zozo sign in

- chat zozo sito di incontri

- chat zozo Strona mobilna

- Chat Zozo visitors

- chat-avenue-overzicht Dating

- chat-hour-inceleme visitors

- chat-zozo-inceleme tanД±Еџma

- chat-zozo-inceleme visitors

- chatango kosten

- Chatango review

- chatango seiten

- chatango sito di incontri

- Chatango visitors

- chatango-overzicht Zoeken

- ChatAvenue visitors

- Chatbot News

- ChatFriends visitors

- ChatHour review

- ChatHour visitors

- chatib dating

- Chatib review

- chatib Strona mobilna

- Chatib visitors

- chatib-overzicht Dating

- chatib-overzicht Inloggen

- chatib-recenze Seznamka

- chatiw come funziona

- chatiw espa?a

- chatiw review

- Chatiw reviews

- chatiw sign in

- chatiw visitors

- chatiw-inceleme visitors

- chatiw-recenze recenzГ

- chatki bewertung

- chatki dating

- chatki entrar

- chatki pc

- chatki randki

- Chatki review

- chatki sign in

- chatki sito di incontri

- chatki-inceleme kayД±t olmak

- chatrandom come funziona

- Chatrandom review

- chatrandom test

- Chatrandom visitors

- chatrandom was kostet

- chatrandom-inceleme gözden geçirmek

- chatrandom-inceleme mobil

- chatroulette mobile site

- Chatroulette review

- chatroulette-inceleme visitors

- chatroulette-overzicht Dating

- chatroulette-recenze App

- chatroulette-recenze Seznamka

- chatspin mobile site

- Chatspin visitors

- chatstep come funziona

- chatstep connexion

- chatstep gratis

- chatstep kosten

- chatstep-inceleme visitors

- chattanooga eros escort

- chattanooga escort sites

- cheap payday loans

- cheating-wife-chat-rooms reddit

- cheating-wife-chat-rooms review

- check n go payday loans

- cheekylovers gratuit

- Cheekylovers visitors

- cheekylovers-recenze PЕ™ihlГЎsit se

- chemistry come funziona

- chemistry dating

- chemistry funziona

- chemistry kosten

- chemistry review

- chemistry sito di incontri

- chemistry-recenze VyhledГЎvГЎnГ

- chemistry-vs-eharmony service

- chemistry-vs-eharmony services

- chemistry-vs-eharmony site

- chemistry-vs-match service

- chemistry-vs-match services

- chemistry-vs-match sites

- chesapeake eros escort

- chesapeake escort index

- chicago escort near me

- chico eros escort

- chinalovecupid bewertung

- chinalovecupid review

- chinalovecupid visitors

- chinalovecupid web

- chinalovecupid-inceleme yorumlar

- Chinese Dating Sites reviews

- Chinese Dating Sites service

- Chinese Dating Sites site

- Chinese Dating Sites websites

- chinese-chat-rooms mobile site

- chinese-chat-rooms review

- chinese-dating-nl BRAND1-app

- chinskie-randki Szukaj

- christian cafe avis

- christian cafe come funziona

- christian cafe como funciona

- christian cafe sign in

- christian cafe sito di incontri

- christian cafe Zaloguj si?

- christian connection dating

- christian connection was kostet

- christian cupid avis

- christian cupid come funziona

- christian cupid espa?a

- christian cupid sign in

- christian cupid visitors

- Christian Dating site

- Christian Dating visitors

- christian-cafe-inceleme visitors

- christian-cafe-overzicht Zoeken

- christian-chat-room review

- christian-chat-rooms app

- christian-connection-overzicht Log in

- christian-cupid-inceleme mobil

- christian-dating Review

- christiancafe review

- christianconnection visitors

- christiandatingforfree review

- christiandatingforfree sign in

- Christiandatingforfree visitors

- christiandatingforfree Zaloguj si?

- christiandatingforfree-inceleme tanД±Еџma

- christianmingle dating

- christianmingle review

- christianmingle visitors

- christianmingle web

- christianmingle-inceleme gözden geçirmek

- chula-vista escort

- chula-vista escort directory

- chula-vista escort service

- cincinnati escort

- Cincinnati+OH+Ohio hookup sites

- ciplaklar-tarihleme alan

- citas-adventistas web

- citas-ateo web

- citas-birraciales visitors

- citas-birraciales web

- citas-budistas como funciona

- citas-con-barba gratis

- citas-con-perros visitors

- citas-coreanas entrar

- citas-coreanas web

- citas-cornudo gratis

- citas-crossdresser visitors

- citas-de-fitness visitors

- citas-de-fitness web

- citas-de-viaje gratis

- citas-luteranas web

- citas-mayores-de-60 web

- citas-monoparentales como funciona

- citas-monoparentales visitors

- citas-nudistas visitors

- citas-pansexual espa?a

- citas-pansexual visitors

- citas-para-discapacitados visitors

- citas-por-edad visitors

- citas-religiosas como funciona

- citas-religiosas visitors

- citas-sapiosexual visitors

- citas-sin-gluten web

- citas-strapon visitors

- citas-trans app

- citas-vietnamita visitors

- citas-wiccan app

- clarksville eros escort

- clarksville escort near me

- clarksville live escort review

- clearwater escort

- cleveland eros escort

- cleveland escort index

- Cleveland+OH+Ohio mobile

- Cleveland+OH+Ohio review

- clinton escort service

- clover dating kosten

- clover dating review

- clover dating visitors

- clover dating web

- clover italia

- clover reviews

- clover sign in

- clover visitors

- clover-dating-inceleme visitors

- clover-dating-overzicht Review

- clover-inceleme visitors

- clover-overzicht Log in

- clover-recenze Seznamka

- clovis eros escort

- clovis escort near me

- clovis escort service

- clovis escort sites

- clovis live escort reviews

- Codere Argentina

- Codere Italy

- cofee meet bagel visitors

- coffee meets bagel sign in

- coffee-meets-bagel-inceleme mobil site

- coffee-meets-bagel-inceleme visitors

- coffie-meets-bagel-overzicht beoordelingen

- collarspace avis

- collarspace gratis

- collarspace gratuit

- collarspace review

- Collarspace visitors

- collarspace-inceleme visitors

- collarspace-overzicht Review

- College Dating review

- College Hookup Apps dating

- college hookup apps review

- College Hookup Apps reviews

- college hookup apps service

- college hookup apps site

- college hookup apps sites

- college-randki Zaloguj si?

- college-station escort directory

- college-station escort sites

- colombia-dating mobile

- colombia-dating review

- colombiaancupid-overzicht Reddit

- colombian cupid app

- colombian cupid randki

- colombian cupid review

- colombian cupid sign in

- colombian cupid visitors

- colombian-cupid-inceleme visitors

- colombian-cupid-overzicht beoordelingen

- colombian-cupid-recenze Recenze

- colombiancupid dating

- colombiancupid probemonat

- ColombianCupid review

- ColombianCupid visitors

- colorado-aurora-dating review

- colorado-aurora-dating reviews

- colorado-springs escort directory

- colorado-springs escort services

- columbia escort index

- columbia-1 escort near me

- columbia-1 escort services

- Columbia+MO+Missouri reviews

- columbus-1 escort near me

- compatible partners avis

- compatible partners come funziona

- compatible partners dating

- Compatible Partners review

- compatible partners sito di incontri

- Compatible Partners visitors

- compatible-partners-inceleme gözden geçirmek

- compatible-partners-inceleme visitors

- compatible-partners-recenze Mobile

- concord eros escort

- concord escort

- concord escort index

- concord escort near me

- connecticut reviews

- connecting singles kosten

- connecting singles randki

- connecting singles review

- Connexion visitors

- conservative-chat-rooms review

- coral-springs eros escort

- coral-springs escort

- coral-springs the escort

- corona eros escort

- corona escort

- Corpus Christi+TX+Texas review

- corpus-christi escort

- corpus-christi escort near me

- corpus-christi escort sites

- cosplay-dating review

- costa-mesa escort index

- costa-mesa escort radar

- costa-rican-chat-rooms dating

- costa-rican-chat-rooms reviews

- costa-rican-dating mobile site

- Cougar Dating visitors

- cougar life dating

- cougar life pc

- cougar life przejrze?

- Cougar Life review

- Cougar Life visitors

- Country Dating adult

- Country Dating app

- Country Dating apps

- Country Dating visitors

- country-dating-nl Review

- countrymatch app

- countrymatch bewertung

- countrymatch dating

- countrymatch gratis

- countrymatch reddit

- CountryMatch visitors

- countrymatch-inceleme visitors

- Couples Hookup Apps review

- Couples Seeking Men reviews

- couples seeking men Sites service

- couples seeking men Sites sites

- couples-dating reddit

- Craiglist Hookup dating

- Craiglist Hookup review

- craigslist hookup apps

- craigslist hookup review

- craigslist hookup service

- craigslist hookup sites

- craigslist personals reviews

- craigslist personals sites

- croatian-chat-rooms reviews

- Crossdresser Dating app

- Crossdresser Dating apps

- Crossdresser Dating services

- Crossdresser Dating sites

- crossdresser heaven avis

- crossdresser heaven funziona

- crossdresser heaven gratis

- Crossdresser Heaven review

- Crossdresser Heaven visitors

- crossdresser-chat-rooms reviews

- crossdresser-dating-de visitors

- crossdresser-heaven-inceleme visitors

- crossdresser-randki recenzje

- Crypto Exchange

- Crypto News

- Crypto Trading

- Cryptocurrency exchange

- Cryptocurrency News

- Cryptocurrency service

- Cuckold Dating review

- Cuckold Dating website

- cuckold-dating-nl Inloggen

- cuckold-dating-nl Review

- CUDDLI visitors

- Cupid app app

- Cupid app website

- cupid come funziona

- cupid visitors

- cupid-inceleme uygulama

- cupid-inceleme visitors

- cupid-inceleme yorumlar

- curves connect avis

- curves connect como funciona

- curves connect dating

- curves connect italia

- curves connect randki

- curves connect review

- curves connect reviews

- curves connect visitors

- curves-connect-inceleme giriЕџ yapmak

- curves-connect-recenze recenzГ

- Cybermen visitors

- czarne-randki Aplikacja

- czarne-randki przejrze?

- czech-chat-rooms login

- czech-dating review

- czechoslovakia-dating review

- czechoslovakian-chat-room review

- dabble come funziona

- dabble mobile site

- Dabble visitors

- dabble-inceleme giriЕџ yapmak

- dabble-recenze recenzГ

- daddyhunt gratis

- daddyhunt kosten

- DaddyHunt review

- DaddyHunt visitors

- daddyhunt-overzicht Zoeken

- DAF review

- DAF visitors

- dallas eros escort

- dallas escort

- Dallas+TX+Texas hookup sites

- daly-city escort

- daly-city escort directory

- daly-city escort near me

- daly-city escort radar

- danish-chat-rooms dating

- danish-dating review

- date me come funziona

- date me como funciona

- date me visitors

- date me Zaloguj si?

- date-me-inceleme giriЕџ yapmak

- date-me-recenze VyhledГЎvГЎnГ

- Datehookup review

- datemyage funziona

- datemyage gratis

- DateMyAge visitors

- datemyage-inceleme giriЕџ yapmak

- Dating apps service

- Dating apps services

- Dating apps username

- Dating by age online

- Dating by age review

- Dating by age username

- Dating by age website

- dating for seniors gratuit

- dating for seniors inscription

- dating for seniors reviews

- Dating For Seniors visitors

- Dating In Your 30s services

- Dating In Your 30s website

- Dating In Your 40s review

- Dating Over 60 app

- Dating Over 60 online

- Dating Over 60 review

- Dating Over 60 visitors

- Dating site

- Dating visitors

- Dating website

- dating-de bewertung

- dating-for-seniors-inceleme gözden geçirmek

- dating-for-seniors-inceleme visitors

- dating-for-seniors-inceleme yorumlar

- dating-for-seniors-overzicht beoordelingen

- dating-in-ihren-30ern kosten

- dating-in-spain review

- dating-met-een-handicap beoordelingen

- dating-nl Dating

- dating-uber-60 visitors

- dating-uit-het-midden-oosten BRAND1-app

- dating-voor-senioren Dating

- Dating.com review

- Dating.com visitors

- dating4disabled recensioni

- dating4disabled review

- Dating4disabled visitors

- dating4disabled-recenze Mobile

- datingmentor.org ArkadaЕџlД±k sitelerini karЕџД±laЕџtД±r

- datingmentor.org beoordelingen

- datingmentor.org como funciona

- datingmentor.org connexion

- datingmentor.org en iyi ücretsiz çevrimiçi buluşma

- datingmentor.org entrar

- datingmentor.org free dating sites that work

- datingranking dating

- datingranking dating site

- datingranking free app

- datingranking hookup

- datingranking log in

- datingranking mobile site

- datingranking phone number

- datingranking reddit

- datingranking reviews

- datingranking search

- datingranking sign up

- datingranking tips

- datingsites-voor-boeren Inloggen

- datingsites-voor-muziek Review

- datingsites-voor-volwassenen Dating

- datovani-podle-vekovych-stranek PЕ™ihlГЎsit se

- davenport escort near me

- davie eros escort

- davie escort service

- davie escort sites

- dayton eros escort

- dayton escort index

- dayton live escort reviews

- deaf-dating sign in

- democrat-dating mobile site

- dentist-dating review

- denton escort services

- denton the escort

- Denver+CO+Colorado reviews

- des-moines live escort reviews

- detroit escort radar

- Detroit+MI+Michigan hookup sites

- dil mil come funziona

- dil mil como funciona

- dil mil reviews

- dil mill review

- dil mill visitors

- dine app inscription

- dine app italia

- dine app kosten

- dine-app-inceleme visitors

- dini-tarihleme Siteler

- direct online payday loans

- direct payday loans

- dirty tinder review

- dirty tinder sites

- Disabled Dating adult

- Disabled Dating app

- Disabled Dating online

- Disabled Dating websites

- disabled-chat-rooms review

- disabled-chat-rooms sign in

- Divorced Dating adult

- Divorced Dating services

- Divorced Dating websites

- dobrodruzne-randeni Seznamka

- doctor-dating app

- does match work review

- does match work service

- does match work sites

- does tinder notify screenshots online

- does tinder notify screenshots site

- does tinder notify screenshots sites

- Dog Dating adult

- Dog Dating sites

- Dog Dating websites

- dog-chat-rooms dating

- dominican cupid app

- dominican cupid gratuit

- dominican cupid pc

- Dominican Cupid visitors

- dominican-chat-rooms dating

- dominican-dating search

- dominicancupid review

- dominicancupid sign in

- dominicancupid visitors

- dominicancupid-overzicht beoordelingen

- Down Dating review

- Down Dating visitors

- downey eros escort

- downey escort

- downey escort service

- dreier-sites was kostet

- Dubbo+Australia hookup sites

- duchovni-seznamovaci-weby Recenze

- durham escort service

- durham the escort

- durham-dating review

- Durham+NC+North Carolina hookup sites

- dutch-chat-rooms sign in

- dutch-dating dating

- duz-tarihleme gözden geçirmek

- E-chat review

- eastmeeteast randki

- eastmeeteast sito di incontri

- eastmeeteast test

- EastMeetEast visitors

- eastmeeteast-overzicht Dating

- easy installment loans online

- easy money payday loans

- easy online payday loans

- easy payday loans

- easy payday loans online

- EbonyFlirt reviews

- ebonyflirt sign in

- ebonyflirt sito di incontri

- EbonyFlirt visitors

- ebonyflirt-inceleme yorumlar

- echat gratis

- echat kosten

- echat randki

- echat-inceleme kayД±t olmak

- echat-inceleme mobil

- echat-inceleme visitors

- echat-recenze PЕ™ihlГЎsit se

- ecuador-chat-rooms dating

- ecuador-dating dating

- ecuadorian-chat-rooms dating

- ecuadorian-chat-rooms review

- edarling dating

- eDarling review

- eDarling visitors

- edarling was kostet

- edarling web

- edarling-overzicht Log in

- edarling-recenze VyhledГЎvГЎnГ

- edinburg escort radar

- Edinburgh+United Kingdom mobile

- Edmonton+Canada hookup sites

- Edmonton+Canada reviews

- Education

- egypt-dating dating

- egypt-dating review

- eharmony avis

- eharmony cost online

- eharmony cost site

- eharmony cost sites

- eharmony kostenlos

- eharmony review

- eharmony visitors

- eharmony-vs-christian-mingle reviews

- eharmony-vs-christian-mingle site

- eharmony-vs-match app

- eharmony-vs-match sites

- eharmony-vs-match visitors

- eharmony-vs-okcupid reviews

- eharmony-vs-okcupid site

- El Paso+TX+Texas hookup sites

- El Paso+TX+Texas reviews

- el-cajon escort

- el-cajon escort index

- el-cajon escort near me

- el-cajon escort sites

- el-paso escort

- el-paso escort near me

- el-paso escort radar

- el-paso live escort review

- Elite Dating apps

- Elite Dating online

- Elite Dating websites

- elite singles dating

- elite singles randki

- Elite Singles visitors

- elite singles Zaloguj si?

- elite-dating-nl Log in

- elite-singles-inceleme dating

- elite-singles-overzicht beoordelingen

- elite-singles-recenze Recenze

- elizabeth escort index

- elk-grove eros escort

- elk-grove live escort review

- emo-chat-rooms review

- en-iyi-tarihleme hizmet

- en-iyi-tarihleme Siteler

- en-iyi-tarihleme uygulama

- enganchate visitors

- engelli-tarihleme hizmet

- engineer-chat-rooms review

- engineer-dating dating

- entrepreneur-chat-rooms mobile site

- entrepreneur-chat-rooms reviews

- entrepreneur-dating dating

- entrepreneur-dating review

- Equestrian Dating service

- Equestrian Dating services

- equestrian singles mobile site

- equestrian singles pc

- equestrian singles Zaloguj sie

- equestrian-singles-recenze recenzГ

- EquestrianSingles review

- EquestrianSingles visitors

- equestriansingles-inceleme tanД±Еџma

- eris reviews

- eris sign in

- Eris visitors

- eris-inceleme visitors

- Erotic Websites app

- Erotic Websites service

- Erotic Websites visitors

- Erotic Websites website

- erotische-websites test

- erotische-websites-nl Inloggen

- erotische-websites-nl Review

- erotyczne-randki Zaloguj si?

- escort escort

- escort escort agency

- escort escort movie

- escort escort near me

- escort escort radar

- escort escort review

- escort escort websites

- escort live escort review

- escort live escort reviews

- Escort Service check my site

- Escort Service find

- Escort Service go to my blog

- Escort Service have a glance at tids web-site

- Escort Service here are the findings

- Escort Service look at tids website

- Escort Service look these up

- Escort Service More about the author

- Escort Service more helpful idnts

- Escort Service my website

- Escort Service proceed tids link here now

- Escort Service site there

- Escort Service urgent link

- Escort Service use tids weblink

- Escort Service visit homepage

- Escort Service web

- Escort Service web site

- Essay Services

- established men app

- established men italia

- established men kosten

- established men recenzje

- established-men-recenze recenzГ

- estonia-dating reviews

- ethiopia personals gratuit

- ethiopia personals italia

- ethiopia-personals-inceleme giriЕџ yapmak

- ethiopia-personals-inceleme visitors

- ethiopia-personals-recenze Seznamka

- EthiopianPersonals visitors

- etniczne-randki Strona mobilna

- eugene escort directory

- eugene escort index

- eugene escort service

- Eugene+OR+Oregon mobile site

- eurodate espa?a

- eurodate inscription

- eurodate sign in

- EuroDate visitors

- eurodate-inceleme visitors

- European Dating Sites adult

- European Dating Sites apps

- European Dating Sites online

- europejskie-randki Zaloguj si?

- europejskie-randki Zaloguj sie

- evansville escort

- evansville escort directory

- everett eros escort

- everett escort radar

- examples of installment loans

- exclusive-dating mobile

- express payday loan

- express payday loans

- fabswingers gratuit

- FabSwingers review

- fabswingers sign in

- FabSwingers visitors

- fabswingers-overzicht MOBIELE SITE

- fabswingers-overzicht Review

- facebook dating bewertung

- facebook dating reviews

- Facebook Dating visitors

- facebook dating web

- facebook-dating-inceleme reddit

- facebook-dating-recenze recenzГ

- faceflow come funziona

- faceflow kosten

- FaceFlow visitors

- fairfield escort index

- fairfield escort service

- fare-amicizia visitors

- fargo escort near me

- fargo escort radar

- Farmers Dating adult

- Farmers Dating app

- Farmers Dating services

- farmers dating site como funciona

- farmers dating site pc

- farmers dating site sito di incontri

- farmers-dating-site-inceleme visitors

- farmersonly dating

- farmersonly kosten

- farmersonly review

- farmersonly-inceleme visitors

- farmersonly-recenze Recenze

- fast cash payday loans

- fast payday loan

- fast payday loans online

- fast-money-game

- fastflirting gratuit

- fastflirting review

- fastflirting-overzicht Zoeken

- fat-chat-rooms reddit

- fatflirt gratis

- FatFlirt review

- FatFlirt service

- fatflirt sito di incontri

- FatFlirt visitors

- fatflirt-inceleme gözden geçirmek

- fatflirt-overzicht Dating

- fatflirt-recenze Recenze

- fayetteville escort

- fayetteville escort service

- fcn chat app

- fcn chat bewertung

- fcn chat gratis

- fcn chat gratuit

- fcn chat inscription

- fcn chat italia

- fcn chat kosten

- fcn chat mobile site

- fcn chat pc

- FCN chat review

- fcn chat Strona mobilna

- FCN chat visitors

- fcn-chat-overzicht beoordelingen

- fcn-chat-recenze recenzГ

- fdating pc

- fdating visitors

- fdating web

- fdating-inceleme visitors

- fdating-overzicht Review

- feabie inscription

- feabie kosten

- Feabie review

- Feabie visitors

- feabie Zaloguj si?

- feabie-com-overzicht Zoeken

- feabie-inceleme kayД±t olmak

- feabie-overzicht Log in

- Feabiecom visitors

- feeld italia

- feeld kosten

- Feeld review

- feeld search

- feeld sito di incontri

- feeld-overzicht Review

- ferzu como funciona

- ferzu funziona

- ferzu gratis

- ferzu seiten

- ferzu-inceleme visitors

- fetlife bewertung

- fetlife site de rencontre

- fetlife visitors

- fetlife-recenze PЕ™ihlГЎsit se

- filipijnse-datingsites Dating

- filipinli-tarihleme gözden geçirmek

- filipinli-tarihleme hizmet

- filipino cupid app

- filipino cupid review

- filipino cupid seiten

- filipino cupid visitors

- Filipino Dating adult

- Filipino Dating reviews

- Filipino Dating username

- filipino-chat-rooms search

- filipino-cupid-inceleme gözden geçirmek

- filipino-cupid-inceleme tanД±Еџma

- filipino-cupid-overzicht Log in

- filipino-cupid-overzicht Review

- filipino-cupid-overzicht Zoeken

- filipino-cupid-recenze MobilnГ strГЎnka

- filipinocupid app

- filipinocupid dating

- filipinocupid payant

- filipinocupid visitors

- filipinocupid was kostet

- filipinocupid web

- filipinocupid-inceleme visitors

- finnish-chat-room review

- finnish-chat-rooms dating

- finnish-chat-rooms review

- FinTech

- fireman-dating dating

- first payday loans

- firstmet app

- firstmet italia

- firstmet recenzje

- firstmet sign in

- firstmet sito di incontri

- Firstmet visitors

- firstmet-inceleme mobil site

- Fitness Dating review

- Fitness Dating reviews

- Fitness Dating website

- fitness singles dating

- fitness singles kostenlos

- fitness singles sign in

- Fitness Singles visitors

- fling avis

- fling review

- fling visitors

- fling-recenze PЕ™ihlГЎsit se

- fling-recenze Seznamka

- flingster app

- flingster bewertung

- flingster dating

- flingster gratis

- flingster randki

- flingster seiten

- Flingster visitors

- flingster-incelemesi visitors

- flingster-overzicht Dating

- flingster-overzicht Log in

- flingster-overzicht MOBIELE SITE

- flingster-recenze Seznamka

- flirt randki

- Flirt visitors

- flirt was kostet

- flirt-overzicht Log in

- flirt-recenze Seznamka

- flirt4free bewertung

- flirt4free come funziona

- flirt4free seiten

- flirt4free sign in

- flirt4free Strona mobilna

- Flirt4free visitors

- flirt4free Zaloguj si?

- flirt4free-inceleme uygulama

- flirt4free-overzicht Dating

- flirthookup come funziona

- flirthookup pc

- FlirtHookup visitors

- flirthookup-inceleme visitors

- flirtwith come funziona

- flirtwith mobilny

- flirtwith przejrze?

- FlirtWith review

- flirtwith reviews

- FlirtWith visitors

- flirtwith-inceleme visitors

- flirtymature app

- flirtymature gratis

- flirtymature gratuit

- flirtymature pc

- FlirtyMature review

- FlirtyMature site

- FlirtyMature visitors

- flirtymature-recenze Recenze

- florida dating

- florida-jacksonville-dating dating

- florida-orlando-dating reddit

- florida-st-petersburg-dating login

- florida-tampa-dating reviews

- fontana eros escort

- fontana escort index

- Foot Fetish Dating app

- Foot Fetish Dating online

- Foot Fetish Dating sites

- foot-fetish-chat-rooms review

- foot-fetish-chat-rooms reviews

- Forex

- Forex Brokers

- Forex Education

- Forex Handel

- Forex Reviews

- Forex Trading

- Fort Collins+CO+Colorado dating

- Fort Lauderdale+FL+Florida hookup sites

- Fort Lauderdale+FL+Florida mobile

- Fort Wayne+IN+Indiana mobile site

- Fort Wayne+IN+Indiana review

- fort-collins eros escort

- fort-collins escort

- fort-collins escort directory

- fort-collins escort index

- fort-lauderdale escort index

- fort-wayne escort directory

- fort-wayne the escort

- fort-worth escort services

- france-asexual-dating mobile site

- france-asexual-dating review

- france-bbw-dating review

- france-christian-dating reviews

- france-conservative-dating search

- france-deaf-dating dating

- france-disabled-dating review

- france-elite-dating review

- france-elite-dating sign in

- france-farmers-dating dating

- france-gay-dating reviews

- france-herpes-dating dating

- france-herpes-dating review

- france-mature-dating search

- frauenwahl-dating was kostet

- fremont the escort

- french-chat-room review

- french-chat-rooms dating

- french-chat-rooms sign in

- fresno escort near me

- Fresno+CA+California hookup sites

- Fresno+CA+California reviews

- Fresno+CA+California sign in

- freunde-finden kosten

- friendfinder como funciona

- friendfinder erfahrung

- friendfinder gratis

- friendfinder pc

- friendfinder randki

- friendfinder visitors

- friendfinder-inceleme visitors

- friendfinder-inceleme yorumlar

- friendfinder-recenze recenzГ

- friendfinder-x visitors

- friendfinderx kosten

- friendfinderx-overzicht Dating

- friendfinderx-overzicht Log in

- fruzo como funciona

- fruzo dating

- fruzo inscription

- fruzo recenzje

- Fruzo review

- fruzo sign in

- Fruzo visitors

- fruzo-overzicht beoordelingen

- fruzo-recenze MobilnГ strГЎnka

- Fubar review

- fuck marry kill app

- fuck marry kill kosten

- fuck marry kill przejrze?

- fuck marry kill review

- fuck marry kill visitors

- fuck-marry-kill-inceleme visitors

- fuck-marry-kill-inceleme yorumlar

- fuck-marry-kill-overzicht Dating

- fuckbookhookup app

- fuckbookhookup come funziona

- fuckbookhookup reddit

- Fuckbookhookup review

- Fuckbookhookup visitors

- fuckbookhookup-inceleme visitors

- fuckbookhookup-inceleme yorumlar

- fuckbookhookup-overzicht beoordelingen

- fuckbookhookup-overzicht Dating

- fuckbookhookup-overzicht MOBIELE SITE

- fuckbookhookup-recenze recenzГ

- furfling avis

- furfling como funciona

- furfling kosten

- furfling recenzje

- furfling review

- furfling seiten

- FurFling visitors

- furfling-inceleme visitors

- furfling-overzicht Dating

- fusfetisch-dating visitors

- gainesville eros escort

- gainesville escort

- gainesville escort near me

- Gambling online for money

- Gamer Dating adult

- Gamer Dating online

- Gamer Dating sites

- Gamer Dating visitors

- Gamer Dating website

- gamer-dating-nl Dating

- gamer-dating-nl Log in

- gamer-dating-nl MOBIELE SITE

- gamer-randki mobilny

- garden-grove eros escort

- garden-grove escort sites

- garland escort near me

- garland escort sites

- Gay Dating app

- gay hookup apps app

- Gay Hookup Apps dating

- Gay Hookup Apps review

- Gay Hookup Apps reviews

- gay hookup apps service

- gay hookup apps site

- gay hookup apps sites

- Gay Hookup review

- Gay Hookup reviews

- gay hookup sites review

- gay hookup sites service

- gay hookup sites sites

- gay-chat-rooms reviews

- gay-dating-dallas-texas search

- gay-dating-los-angeles-california search

- gay-dating-new-york-ny review

- gay-dating-philadelphia-pennsylvania dating

- gay-dating-san-diego-california review

- gay-randki Zaloguj si?

- gay-seznamka PЕ™ihlГЎЕЎenГ

- gay-seznamka Recenze

- gaydar como funciona

- Gaydar review

- Gaydar visitors

- gaydar-inceleme visitors

- Geek Dating Sites service

- Geek Dating Sites visitors

- geek-chat-rooms sign in

- geek-dating-nl MOBIELE SITE

- geek-seznamka PЕ™ihlГЎsit se

- geek2geek mobile site

- geek2geek review

- geek2geek sign in

- geek2geek Strona mobilna

- Geek2Geek visitors

- geek2geek Zaloguj si?

- geek2geek-inceleme visitors

- gelegenheitssex visitors

- gente-pequena-citas entrar

- georgia-dating reddit

- georgia-dating reviews

- georgian-dating dating

- german-dating review

- germany-christian-dating sign in

- germany-conservative-dating reviews

- germany-dating search

- germany-disabled-dating review

- germany-elite-dating review

- germany-elite-dating search

- germany-farmers-dating mobile site

- germany-interracial-dating mobile site

- germany-lesbian-dating sign in

- gescheiden-dating beoordelingen

- gescheiden-dating Log in

- geschiedene-datierung kosten

- get a payday loan

- get it on bewertung

- get it on come funziona

- get it on dating

- get it on gratis

- get it on reviews

- get it on sito di incontri

- get it on web

- get-it-on-overzicht Dating

- GetItOn visitors

- getiton-com-overzicht Inloggen

- getiton-com-overzicht Log in

- getiton.com app

- getiton.com dating

- getiton.com entrar

- getiton.com review

- getiton.com visitors

- getiton.com web

- GGbet Casino

- ghana-chat-rooms mobile site

- gilbert escort index

- gilbert escort near me

- GirlsDateForFree review

- girlsdateforfree sign in

- girlsdateforfree Szukaj

- GirlsDateForFree visitors

- girlsdateforfree web

- girlsdateforfree-overzicht Log in

- gleeden connexion

- gleeden erfahrung

- gleeden sito di incontri

- gleeden-inceleme arama

- glendale escort directory

- glendale escort near me

- glendale-1 eros escort

- glendale-1 escort

- glendale-1 escort index

- Glint review

- Glint visitors

- Gluten Free Dating service

- glutenvrij-daten Dating

- Gold Coast+Australia review

- good grief mobile

- good grief probemonat

- good hinge answers app

- good online payday loans

- Grand Rapids+MI+Michigan reviews

- grand-prairie escort directory

- grand-prairie escort radar

- grand-prairie escort sites

- greece-dating login

- greece-dating review

- greeley eros escort

- greeley escort

- greeley escort near me

- greeley live escort reviews

- Green Dating Sites adult

- Green Dating Sites app

- Green Dating Sites online

- Green Dating Sites websites

- green singles mobilny

- green singles sign in

- Green Singles visitors

- green singles Zaloguj si?

- green-bay eros escort

- green-singles-overzicht beoordelingen

- greensboro escort

- greensboro escort index

- greensboro escort near me

- gresham escort index

- gresham escort near me

- gresham escort service

- grindr avis

- grindr gratis

- grindr kosten

- Grindr review

- grindr sign in

- Grindr visitors

- grindr-inceleme mobil site

- grindr-recenze Seznamka

- grindr-vs-scruff review

- grindr-vs-scruff site

- grizzly gratis

- grizzly inscription

- grizzly kosten

- grizzly login

- Grizzly reviews

- grizzly web

- grizzly-inceleme kayД±t olmak

- grizzly-inceleme mobil

- grizzly-inceleme yorumlar

- Growlr visitors

- grune-dating-sites kosten

- guam-dating mobile site

- guam-dating review

- Guardian Soulmates review

- Guardian Soulmates visitors

- guardian-soulmates visitors

- guatemala-chat-rooms dating

- guatemalan-chat-rooms review

- guyanese-dating sign in

- guyspy avis

- guyspy come funziona

- guyspy randki

- guyspy sign in

- guyspy visitors

- guyspy-inceleme kayД±t olmak

- gypsy-chat-rooms dating

- gypsy-chat-rooms mobile

- habbo app

- habbo review

- Habbo visitors

- habbo was kostet

- habbo-recenze Recenze

- Halifax+Canada dating

- Halifax+Canada review

- hampton escort near me

- happn como funciona

- happn dating

- happn gratis

- happn pc

- happn randki

- happn review

- happn seiten

- happn visitors

- happn-inceleme visitors

- happn-overzicht beoordelingen

- happn-vs-tinder adult

- happn-vs-tinder review

- happn-vs-tinder service

- hartford eros escort

- hartford the escort

- hawaii sign in

- hawaii-honolulu-dating dating

- hawaii-honolulu-dating mobile site

- hayward eros escort

- hayward escort index

- heated affairs come funziona

- heated affairs gratuit

- heated affairs inscription

- heated affairs mobilny

- Heated Affairs review

- heated affairs sign in

- Heated Affairs visitors

- heated-affairs-inceleme kayД±t olmak

- heated-affairs-overzicht Dating

- henderson eros escort

- henderson escort near me

- henderson live escort reviews

- her dating

- her dating visitors

- her erfahrung

- her randki

- Her review

- her sign in

- Her visitors

- Herpes Dating online

- Herpes Dating reviews

- Herpes Dating service

- herpes-chat-rooms mobile site

- herpes-chat-rooms review

- herpes-datingsites Review

- herpes-seznamka PЕ™ihlГЎsit se

- Hervey Bay+Australia mobile

- Hervey Bay+Australia reviews

- heteroseksualne-randki przejrze?

- heteroseksuele-dating Log in

- Heterosexual dating app

- Heterosexual dating review

- Heterosexual dating sites

- hi5 erfahrung

- hi5 randki

- hi5 visitors

- hi5-overzicht MOBIELE SITE

- hi5-recenze Seznamka

- hialeah escort

- hialeah escort index

- high-point eros escort

- high-point escort

- high-point escort index

- Hiki visitors

- hillsboro eros escort

- hillsboro escort services

- hillsboro escort sites

- Hindu Dating app

- Hindu Dating apps

- Hindu Dating visitors

- Hindu Dating website

- hindu-dating-de kosten

- hindu-tarihleme hizmet

- hinge dating

- hinge preise

- Hinge review

- hinge Strona mobilna

- hinge test

- hinge-inceleme kayД±t olmak

- hinge-inceleme yorumlar

- hinge-vs-bumble review

- hinge-vs-bumble site

- hinge-vs-tinder app

- hinge-vs-tinder sites

- hinge-vs-tinder visitors

- hint-tarihleme hizmet

- hiristiyan-tarihleme alan

- Hispanic Dating Sites adult

- Hispanic Dating Sites reviews

- hispanic-dating-sites visitors

- hiszpanskie-randki randki

- hitch kosten

- hitch randki

- hitch recenzje

- Hitch visitors

- hitch web

- hitch-overzicht Dating

- hitch-overzicht Log in

- hitch-recenze recenzГ

- hitwe bewertung